in the Amount column,

the same accounting block information will be applied to all commodity

items.

in the Amount column,

the same accounting block information will be applied to all commodity

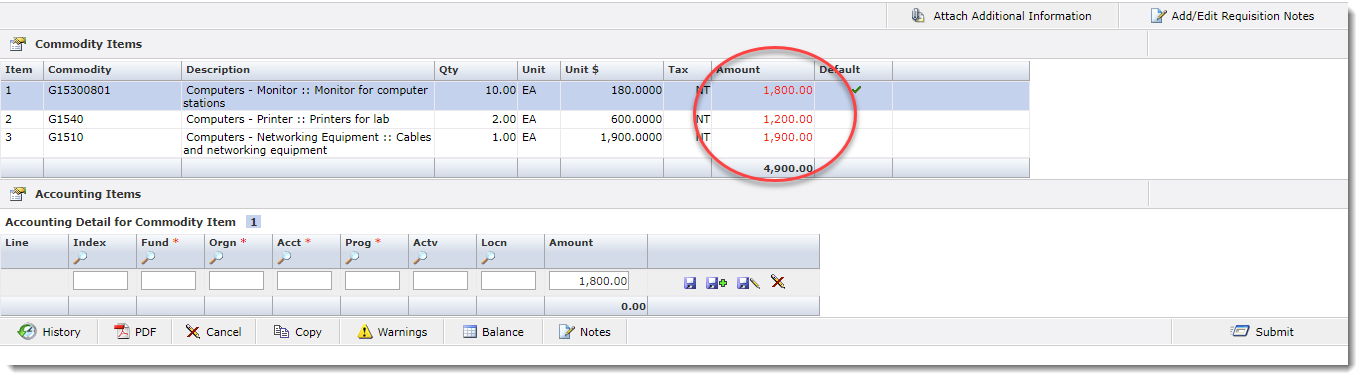

items.If the Commodity Item Amount on the requisition is red, the accounting line is not balanced or no accounting lines have been created.

You can enter accounting codes to balance the commodity items, with the option of splitting the amount over multiple accounting lines. Required fields are institution specific and have an asterisk beside the code name.

If you have previously created a requisition and are returning to add accounting information, do the following:

On the Requisitions menu, click Open | Standard, and then select the requisition number.

On the FAST Web Requisitioning Home Page, click the Quick Launch tab, expand a section, then click the requisition number to retrieve and complete it.

If there is a green check  in the Amount column,

the same accounting block information will be applied to all commodity

items.

in the Amount column,

the same accounting block information will be applied to all commodity

items.

If you opened the requisition from the menu, the accounting line opens for the first commodity item.

If no longer want this requisition, in the accounting line at the bottom

of the page, you can click  Cancel.

Cancel.

Click the red amount for a commodity item.

If

the accounting line is not open, click  Add

Accounting Item.

Add

Accounting Item.

Do one of the following (required fields are institution specific and have an asterisk beside the code name):

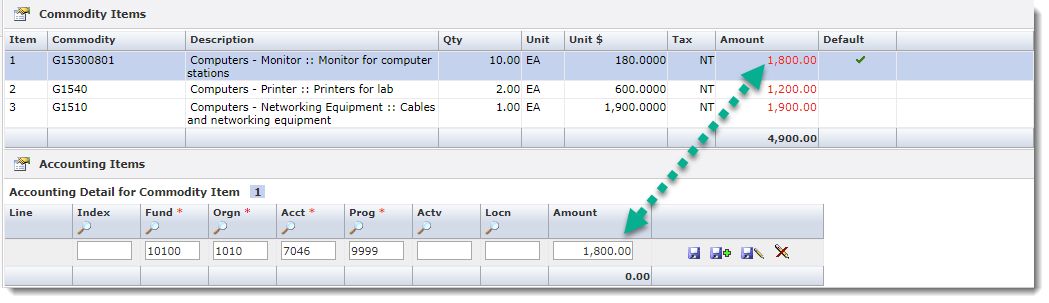

Type or search for an Index to add the pre-defined accounting codes (institution specific).

Type or search for specific accounting codes.

Ensure that all the mandatory fields (marked with a red asterisk) are completed before saving

Type the Amount for the Commodity Item. If you are splitting the accounting line, type the split amount.

Do one of the following:

Click  to save

the accounting information.

to save

the accounting information.

If you are splitting

the accounting line, click  to open another line. Repeat Step 3 and 4.

to open another line. Repeat Step 3 and 4.

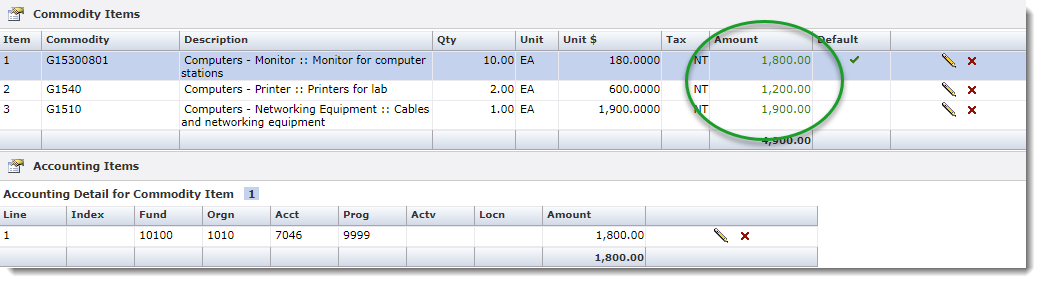

The Commodity Item Amounts change to green, indicating they are balanced.

In the header record, click Save Requisition. If you are adding the accounting information on a different date than you created the header record, you may have to change the Required Date.

Do one of the following:

Exit and return later.